With the Bitcoin price ploughing through its all-time high and Ethereum price surging over 100% in three weeks, heads are turning to crypto again. There’s a running joke in the industry that you can tell we are entering the bull market when you get texts from distant relatives and friends asking for coin recommendations. In some ways, it all feels familiar to the beginnings of the ICO frenzy in 2017, a period that ended wonderfully for some but devastating for many.

But besides the uptick in Google searches and fear-of-missing-out (FOMO) behavior, the ecosystem is fundamentally different from what it was then. In this article I will touch on:

How this bull run is different from the one in 2017

What I would tell myself if I got into crypto today

This is non-financial advice that will hopefully help you preserve your sanity, protect your assets, and really get to know what the space is about beyond charts and prices.

What I am anticipating this year as a builder and active participant in the Ethereum ecosystem

A growing user base

For those that stuck around after the 2017 cycle, it was a matter of continuing the work towards the future we touted. An open, censorship-resistant financial system that is indiscriminate of where you live, who you know, and what you do for a living. One key feature of this future is that as many people should own a piece of its native asset as possible.

Therefore, a sign of progress is increased dispersion of supply: the number of wallet addresses holding the asset in amounts consistent with laypersons would have (vs. high net-worth individuals, exchanges, or institutions). We can see evidence of this in the distribution of Bitcoin.

Number of Bitcoin addresses with $10+ worth of BTC. Source: CoinMetrics

A strong concentration of funds could allow a small set of users to exert significant influence over the direction of markets and protocol development. In other words, dispersion metrics are an indicator to how “decentralized” a cryptocurrency is. In the early days, BTC and ETH were held by few individuals, but both gradually got dispersed to millions of addresses over time. This can’t be said for other coins like Bitcoin Cash (BCH), whose supply got more concentrated since its fork off Bitcoin in the summer of 2017.

Increased dispersion also means that more people have been “onboarded” onto this new financial system, granting them immediate access to whatever applications and services that run on top of it. The larger the potential user base, more attractive these protocols are for developers to build products and services on them.

There has been an explosion in the types of crypto-native activities you can engage in (beyond payments) over the past 3 years. This is partly thanks to the fact that developers don’t need permission to deploy their apps on Bitcoin’s Lightning Network or on Ethereum, and no one can take it down once they do. So while the quality of these apps vary a lot more than what is found on the App Store, developers can implement their ideas, test it with real users, and iterate right away. Meanwhile, Apple not only decides whether or not to list an app on the App Store, they can also remove it at any time.

Richer developer experience

In 2018 I started playing around with Solidity, the programming language used to write Ethereum applications. Back then, resources were scattered all over the web and developer tools were still bug-ridden. This often meant that I was spending more time figuring out how to set up a project rather than building the project itself. Today, the same “setting up” tasks have been automated and can be achieved in a single line of code. So I can spend more time making the app instead of tinkering with lower-level scaffolding.

Auxiliary tools like testing libraries, security auditors, and libraries that help you connect your website to the blockchain have proliferated and are used in production by some of the most prominent projects today. It’s now much easier for developers to experiment with the blockchain with the emergence of tools that are analogous to what they are used to for traditional apps.

Developers have more opportunities to integrate with and build off of other protocols. If you need liquidity or exchange functionality in your project, you can integrate Uniswap without having to reinvent this wheel. Today, a team ideating on new products and services can think one level of abstraction up.

Instead of “how do we implement X and Y”, the question becomes “how do we use existing implementations of X and Y to create Z”.

A product made of money legos. Aavegotchi are digital collectables backed by the Aave lending protocol. Note: I have no formal affiliation with either project but am an Aave user. I’m also currently experimenting with Aave protocol for an upcoming hackathon.

money legos

Innovation compounds faster in this ecosystem because every protocol lays new grounds for more sophisticated products and use cases. Aavegotchi - digital collectables backed by interest-bearing assets - is only possible because of Aave, the lending protocol that backs and generates these assets. Now you can have tradable ghost avatars that derive their sentimental value from unique trait compositions, and intrinsic value from being backed by a savings account. What of the pre-crypto world can be analogous to this?

“Programmable money” and “money legos” are pervasive memes in the Ethereum ecosystem at the moment. There aren’t good analogies from traditional finance to explain these ideas because permissionless composability is something that public blockchains uniquely unlock. We were told this in 2017, but today we can directly experience how powerful this is. The building blocks of decentralized finance, the features and liquidity that comes with it, are now importable just like other open source libraries on npm and gems.

A higher bar for emerging projects

The flip side of all this is that as more complex experiments proliferate, many will have design flaws that often result in an unrecoverable loss of funds. Project leaders have dealt with attacks in a variety of ways: from compensating users’ losses out-of-pocket, to putting up a bounty for the exploiter to return the funds. Because the code is public, any security flaw will be exploited if there is profit to be made.

The industry’s learning cycles are rapid and ruthless. Attacks play out in a matter of hours or days, and there are humbling lessons to be learned with every post-mortem. If you’re technically-minded, there’s lots to learn from watching the arms race between potential exploiters and white-hats.

Well-respected teams are transparent about their mistakes and progress. We have accrued a lot of knowledge about common attack vectors and the best practices to address them over the past few years. This knowledge, coupled with the options for auditing services like Trail of Bits, Quantstamp, ConsenSys Diligence and Open Zeppelin, means that the ecosystem has a higher bar for what constitutes a serious project.

Whitepapers are no longer enough. If teams want their app to be considered anything more than a toy, they need to demonstrate the steps they have taken to protect users. Most projects are still experimental and in their early days, but they are robust enough for everyday use for those who can tolerate the risk.

An ecosystem that funds itself

As protocol-layer coins like BTC and ETH appreciate in value, their respective networks become more secure. It also means there is more money around to reinvest in things that benefit the ecosystem as a whole.

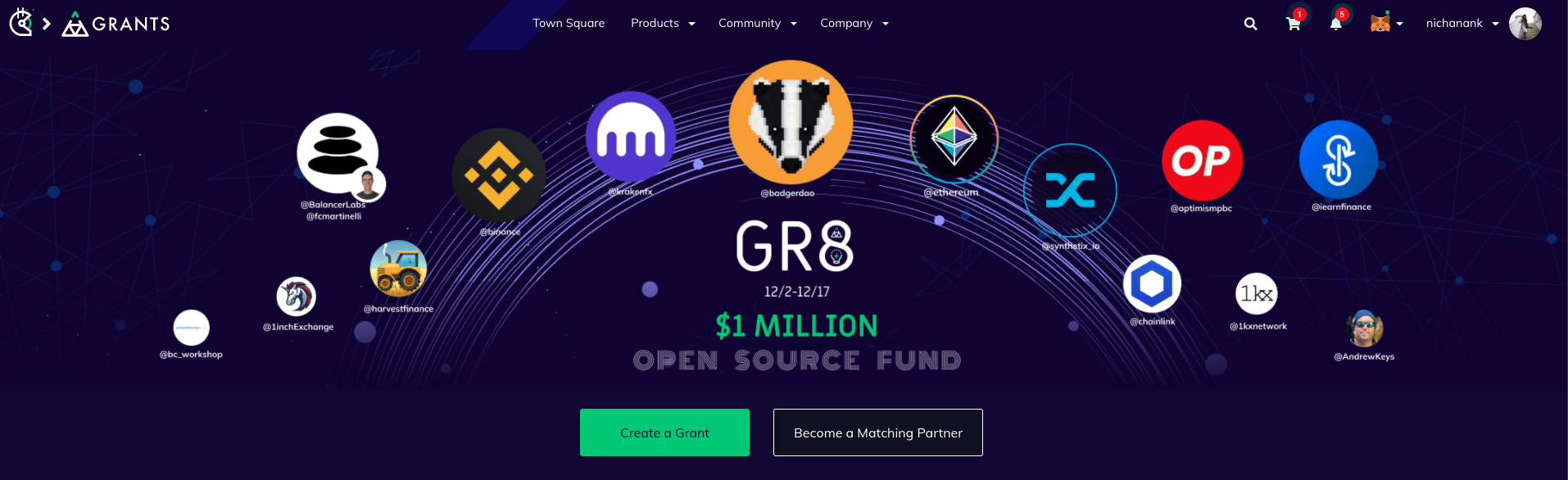

Gitcoin Grants has deployed $6.5M in public goods funding over the past 2 years for the Ethereum ecosystem. Individuals can give as little as a dollar and have their contributions matched through the quadratic funding algorithm. Under this paradigm, the number of contributors matters more than amount funded, which means that a public good towards which 200 people gave $1 will receive more in grant matching than those with 3 contributions of $100. It’s even possible to get up to 100x matching multipliers on $1 crowdfund contributions. The long tail community of users now have a louder voice in signaling the public goods and services that they value, pushing the power away from whales.

The latest grants round offered $1M in funding matching towards public goods.

Matchers for earlier grants rounds were entities like ConsenSys and Ethereum Foundation. But we are now starting to get DeFi protocols like yearn and Synthetix - who did very well during “DeFi summer” - paying it forward to lead matching in recent rounds.

Since many of the recipients are individuals who are propping up and securing the infrastructure holding up our digital assets, it is a rational economic act to make sure they are well-funded. Some examples of grants recipients through community contributions and matching:

ethers.js is a popular open-source Javascript library that allows web3 developers to hook their web applications up to the Ethereum blockchain. Raised $80k+

samczsun is a prominent individual in the space who has rescued millions of dollars from through white-hat activities. Raised $100k+

EthHub is an open-source, community-driven resource hub for all things Ethereum. Raised $150k+

In the midst of hacks, unstable prices, and greedy behavior, this is a refreshing reminder that there is real technical and social progress happening in the ecosystem, and individuals are making a living on the internet through avenues that were simply unavailable a few years ago.

What I would tell myself if I was entering the market today

1. adopt good online privacy and security practices

I’ve seen many how-to’s for beginners to get into crypto. But it’s astonishing that a vast number of them omit the importance of good security practices (OPSEC). As more money pours in, the ecosystem becomes an even bigger honeypot for watchful attackers. It only takes visiting, clicking, or installing the wrong thing to accidentally give away your money.

Banks and platforms like Facebook have standardized steps to help you regain access to your account if you happen to lose your password. After all, your account is ultimately under their control. But if you accidentally share or lose your private keys, there is no Bitcoin or Ethereum customer service to help you recover the lost funds. Crypto is truly yours to own, and it’s also truly yours to lose.

Be extra weary when installing extensions or apps. Make sure it is the legitimate version (MetaMask, Ledger Wallet etc.)

Many impersonators use paid ads on Google to appear at the top of search results. Check you are going to the correct links, and check the link again before entering your information. NEVER give away your private keys.

Double check that the person you’re messaging is who you think it is and not an impersonator.

You don't need to own crypto to start caring about online privacy and digital security. Information about where you live, your phone number, and your Social Security/ID numbers, are all worth protecting. A few months ago I put on a small workshop to help people step up their security game. Here is the presentation and its article form that also lists some privacy-preserving alternatives for every day products like messengers, browsers, and search engines.

2. be open to changing your mind

The articles you read, podcasts you listen to, and people you follow on Twitter all influence your world view. Don’t underestimate how powerful these are. Once you dive in, you’ll quickly find clashing opinions about the vision of crypto and how we will get there. Depending on who you listen to, you’ll start to form your own views and become excited about certain use cases and skeptical of others.

Being open-minded is easy when you are new and have not yet formed opinions on things. Being open-minded is harder once you have developed a worldview and someone disagrees with you. Strong voices and salient messaging makes it feel like the current narrative will be the one that sticks. Bitcoin has gone through 7 major narrative shifts since its inception in 2009. When I entered the space, people were touting Ethereum as the “world computer”. Today, it’s programmable money and all things DeFi. What might it be in a year, or 5?

To believe in progress is to accept that the current knowledge is either insufficient or wrong. If you find yourself agreeing with everything you read or hear, it's a sign you might be sitting too comfortably in a bubble. So once you’ve gotten an initial handle on things, actively seek disconfirming information and be open to changing your mind. This is hard to do on your own, which brings me to my next point.

3. Join real communities

The crypto industry has attracted some of the brightest creative and technical minds in the world. Now is as good a time as ever to find them and learn from each other. Being a pure autodidact in crypto is risky, because there is no one to be a sounding board for your views and give you the information you might be missing. Share your ideas with them, participate in their calls, make decisions with them. Disagreements are good when they make you articulate why you believe what you believe. And if you happen to have these nuanced discussions in public, I think that’s a net positive for the whole ecosystem.

In 2017, the majority of projects used Slack and Telegram to communicate with prospective token buyers. The typical cycle was: discover upcoming project through YouTube or Twitter, join their Slack, learn how to participate in the ICO, maybe go through KYC/AML, exchange money for coin, then monitor portfolio in the hopes that numbers go up. You then participate in speculative discussions on Slack with people who shared no values or incentives with you other than the price of the coin. Sadly, this sort of engagement had been enough to be considered a project’s "community".

One of the most rewarding things about staying engaged in the ecosystem has been the people I met, and how much I have grown as a writer, builder, and individual thanks to them. Some communities that have shaped my career and views over the past year:

Meta Gamma Delta - a community on a mission to support & fund women-led projects in web3. See MGD’s 2020 Recap.

Meta Cartel - a community of developers, designers, operators, and thinkers who have started, funded, and are running some of the most prominent projects on Ethereum today. See 2020 Recap.

Mochi DAO - a community to share and be held accountable for your goals with accountability groups and staked ETH.

TokenSmart and WIP Meetup - a Discord community for all things NFTs with weekly meetups in the metaverse to discuss work-in-progress (WIP) with project leaders.

KERNEL - a community dedicated to a better understanding of web3, and its role in our relationships with ourselves and others. Also an incubator for ideas and projects in the space.

There is much value to gain from the ecosystem besides profit. Find your people. Pay it forward.

4. try the products… responsibly

The closest you can get to interacting with most of the blockchain apps being talked about in 2017 is through your imagination. Today, at the time of writing, there is over $20B locked up in decentralized finance (DeFi) protocols built on Ethereum and $40M on Bitcoin’s Lightning Network.

I have personally found it more intellectually valuable and financially responsible to use crypto products as opposed to just charting prices and trading coins. The ethos isn't just to accrue wealth but to empower individuals to opt into a more inclusive economic system. Now that the alternatives are here and gaining serious traction, why not try them out to see what this future feels like?

This does not mean diving headfirst into leveraged positions and risky yield farming strategies. I consider even the most well-regarded projects today to be prominent experiments. Define how much risk you can tolerate and how much you are willing to lose. If you already have some ETH, try trading it to DAI stablecoin and deposit that DAI into a lending protocol to start earning interest on it. This is a relatively modest way to experiment with DeFi products, but it nevertheless puts you ahead of most people in the game. If finance isn’t your thing, I’d suggest checking out the world of NFTs and tokenized communities.

5. keep yourself grounded

I think doing the above steps right will help you with this one. But nevertheless it is sometimes very tempting to treat this whole thing like a money theme park. Figure out for yourself why you are here, beyond the profits. This vision will anchor you both in times of greed and times of doubt. Set boundaries for how much money you put in and how often you check prices. Don’t wipe yourself out in the FOMO vortex.

things i’m anticipating in 2021

The arms race between project teams (+ whitehats) and exploiters will rage on. At least one prominent protocol on Ethereum will get exploited due to a design flaw, resulting in a significant loss of funds. However, I think it is unlikely that this will be Uniswap, Compound, Aave, or Maker by virtue of how long they’ve been around and the amount that has been invested in their security. A sophisticated attack could still leverage these protocols though. Composability creates attack vectors that are obvious only in retrospect.

Visual artists have flocked to the cryptoart scene thanks to platforms like SuperRare, NiftyGateway, and MakersPlace. We will see a similar trend for musicians as more audio gets tokenized. The space is ripe for experimentation with audio NFTs - royalties and streaming licenses being possible features.

Further proliferation of low-quality and counterfeit NFTs on DIY platforms like Rarible and OpenSea. Serious collectors will call for more transparency on where NFT media is hosted, and who is responsible for keeping them so. There will be a bigger push towards decentralized (IPFS or on-chain) storage for NFT media and metadata. nft42 are strong proponents and are pushing the envelope in this area with projects like Avastars and InfiNFT. Arweave is emerging as a good candidate for decentralized storage for media.

Richer gaming experiences on the blockchain thanks to L2-scaling solutions like xDAI and Matic Network. Over the holidays I spent many hours on Dark Forest, a realtime strategy game that runs on xDAI PoS chain. Axie Infinity will continue to dominate NFT gaming thanks to a passionate community and play-to-earn prospects. They are also migrating to L2 with Ronin sidechain, built in-house.

Network congestion and high gas prices will motivate new projects to launch on L2 from the get go, driving further competition between plug-and-play scaling solutions. These dapps will have smoother onboarding that will make the ecosystem more accessible for first-time users.

Mainstream influencers and artists will enter the social tokens arena, resulting in an explosive but unsustainable growth in this area. I am still optimistic about social tokens and community-owned creative projects, but there are painful lessons to be learned before the industry knows how to do this well. There will be increased demand for products and services that help individuals manage their social tokens. Roll, Cooper Turley, and Seed Club are early examples.

We’ll see more token-gated communications channels and content, aimed to incentivize users to engage in community activities. For example, some channels on the TokenSmart Discord can only be accessed if you own a certain number of WIP Tokens, obtainable through WIP meetup attendance. Jamm Session entries are are only accessible to holders of $JAMM personal token.

Discord will be the home of communities in general (instead of Telegram). Lots of meetups happening there already.

More partnerships to onboard major IPs into the NFT space following the early success of NBA Top Shot. Dapper Labs will continue to be the top contender for these sorts of deals with Flow blockchain.

Launch of a product that finally allows users to display their cryptoart and digital collectables outside of virtual environments like Decentraland and CryptoVoxels. Nifty Gateway is working on this, but it is only currently limited to NFTs bought on their platform. As well as physical displays I’d also love it if I can embed my NFT collection on this website the same way I can plug in my Instagram Feed.

Popular but not-yet-tokenized products will do a Uniswap-like retroactive token airdrop to reward early users. These tokens will be good for governance if the projects decide to decentralize their decision-making and “exit-to-the-community”. Candidates include Zapper, Zerion, and OpenSea. Note: I have no insider knowledge on this.

Clearly, these predictions are indicative of my optimistic long-term view of Ethereum. This is contingent upon a no-disasters progress towards Eth 2.0. The momentum and amount of investments made into Ethereum is unmatched by other blockchains who are touted to be “Ethereum killers”, and scaling solutions are rapidly emerging and tested in the wild. I’m also as bullish as ever about Bitcoin, but my activity there is simply buy-and-hold, there isn’t much to say about that.

This article ran way longer than I anticipated so I will stop here. I enjoy hearing people’s predictions of the space and spicy takes on current developments. So reach out and let me know what you think! If you are a newcomer and aren’t sure where to dive in, would be happy to answer specific questions about anything that sticks out to you in this article. None of this is intended to be investment advice. If anything, I hope it motivates you to up your digital security game and raises your curiosity enough to dive deeper into the rabbit hole.

Until next time,

Nich